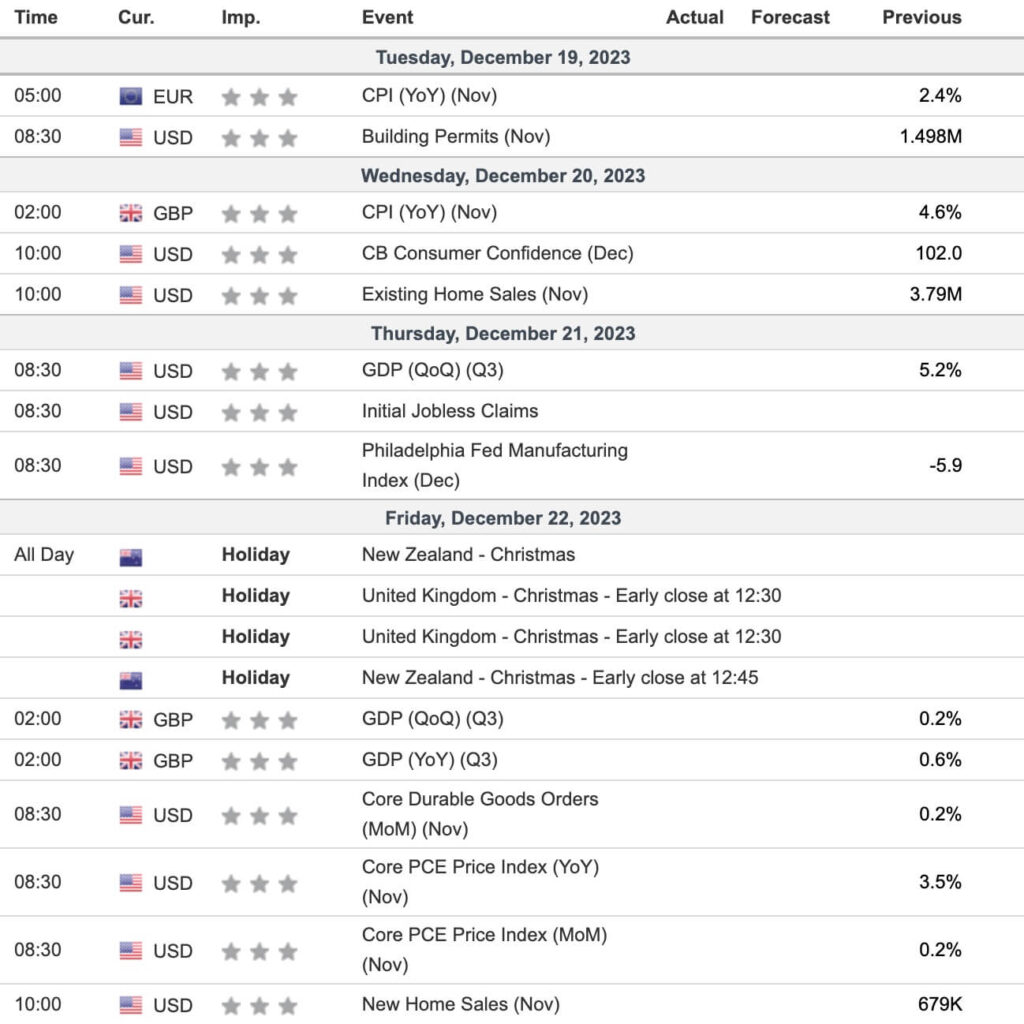

In the text below, we will analyze several key upcoming economic events. An eventful week is on the horizon in the world of economics, but rest assured; we’ll clarify each event in an easy-to-understand way. Even if you don’t have a deep background in economics, we’ll ensure you have a clear insight into the importance of each event, helping you comprehend how they might affect you personally and the broader economy.

- U.S. GDP (QoQ) (Q3) – 5.2%: Gross Domestic Product (GDP) measures the total value of all goods and services produced by an economy. An increasing GDP indicates a growing economy. A growth of 5.2% is quite significant and suggests a robust expansion of the U.S. economy. This can affect global markets, as a strong U.S. economy often leads to increased consumption, which can benefit the economies of other countries that export to the U.S.

- Eurozone Consumer Price Index (CPI) (YoY) (Nov) – 2.4%: The CPI measures the change in prices of a basket of consumer goods and services. A high CPI can indicate inflation, which could lead central banks to raise interest rates to control it. A CPI of 2.4% is relatively moderate, suggesting that inflation in the eurozone is under control, which is important for the economic stability of the region.

- UK Consumer Price Index (CPI) (YoY) (Nov) – 4.6%: Similar to the Eurozone CPI, but for the United Kingdom. A CPI of 4.6% is higher and may indicate greater inflation. This could affect the monetary policy of the Bank of England, possibly leading to an increase in interest rates. A high CPI in the UK can have a significant impact on financial markets and the global economy, especially in the context of Brexit and its economic challenges.

- U.S. Existing Home Sales (Nov) – 3.79M: This indicator measures the number of previously owned homes sold during the month. Home sales are a good indicator of overall economic health, as a home is the largest purchase most people make. A high number suggests a strong real estate market and, by extension, a strong economy. This can influence consumer markets and investor confidence.

- U.S. Core Personal Consumption Expenditures (PCE) Price Index (YoY) (Nov) – 3.5%: This index measures the change in prices of goods and services consumed by households, excluding food and energy. It is a key measure of inflation that the U.S. Federal Reserve uses to make monetary policy decisions. An increase in this index can indicate rising inflation, which could lead the Federal Reserve to raise interest rates to cool down the economy. This has global implications, as the Federal Reserve’s decisions affect global financial markets.