In the following text, we’ll break down some of the most significant economic events on the horizon. Don’t worry if you’re not well-versed in economics; we’re going to explain the significance of each event in a straightforward and clear manner, so you can understand how they might personally affect you and the economy at large.

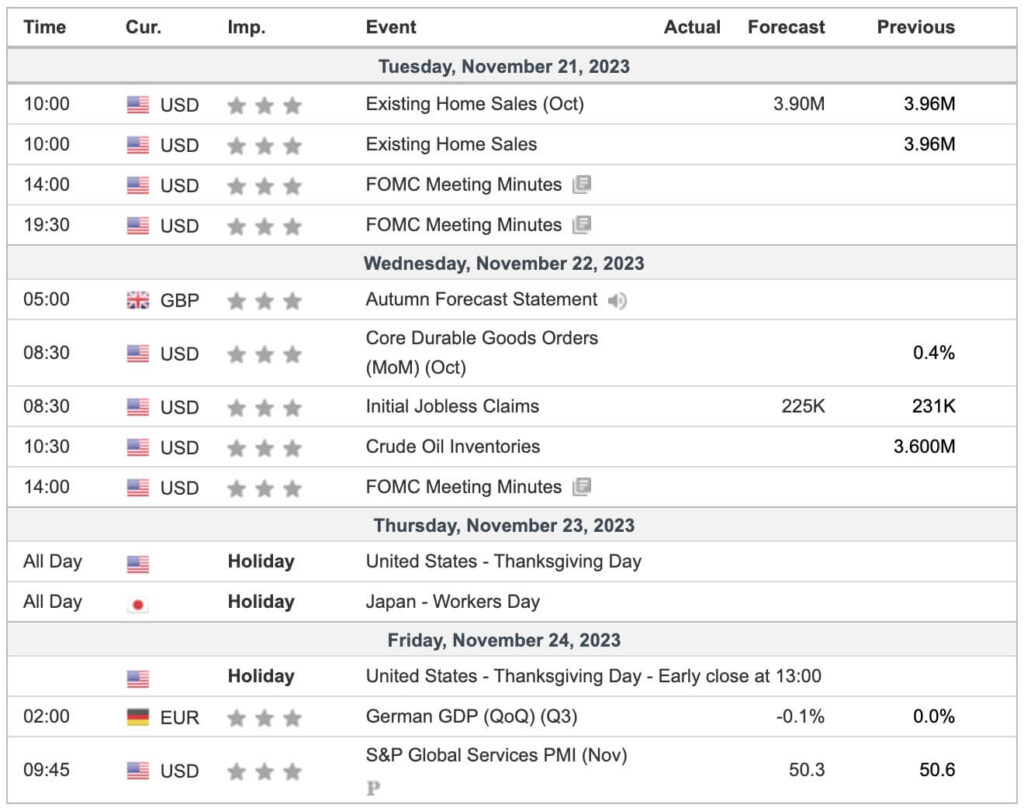

- Existing Home Sales (U.S.): This data shows how many existing homes were sold in a specific month. High sales indicate a healthy economy because it means people have enough money to buy houses. If sales are down, it might signal that the economy is slowing, as fewer people can afford to buy homes.

- FOMC Meeting Minutes (U.S.): The Federal Open Market Committee (FOMC) is part of the U.S. Federal Reserve and makes key decisions about interest rates. The minutes of their meetings give us clues about what they might do in the future. If they suggest interest rates might rise, it could strengthen the U.S. dollar but also make borrowing more expensive, potentially slowing down the economy.

- Autumn Forecast Statement (UK): This is an update on the UK’s economy. It tells us how the economy is doing and what’s expected in the future. Positive forecasts can be good for the British pound and confidence in the UK economy. Negative forecasts could have the opposite effect.

- Core Durable Goods Orders (U.S.): This measures how much businesses and consumers are spending on long-lasting goods, like appliances or cars. An increase means businesses and consumers are spending more, which is good for the economy. A decrease could indicate less spending, signaling economic troubles.

- Initial Jobless Claims (U.S.): This tells us how many people are filing for unemployment benefits for the first time. A high number of people losing their jobs is a bad sign for the economy. Fewer people filing for unemployment benefits is a good sign, indicating more people are employed.

- Crude Oil Inventories (U.S.): This tells us how much oil the U.S. has stored. If there’s a lot of oil stored and demand is low, oil prices might drop, which can be good for consumers but bad for oil-exporting countries. If there’s little storage and high demand, oil prices might rise.

- German GDP (Germany): The Gross Domestic Product (GDP) measures how much an economy grows or shrinks. If Germany’s GDP is down, it might signal that Europe’s largest economy is struggling, which can affect other European and global economies.

- S&P Global Services PMI (U.S.): This index measures the health of the U.S. services sector. A number above 50 indicates expansion and is good for the economy, while a number below 50 indicates contraction, which can signal economic troubles.

These events are closely monitored by investors and analysts as they can cause volatility in the forex, stock, and bond markets, and provide insight into the future direction of economies and monetary policies.