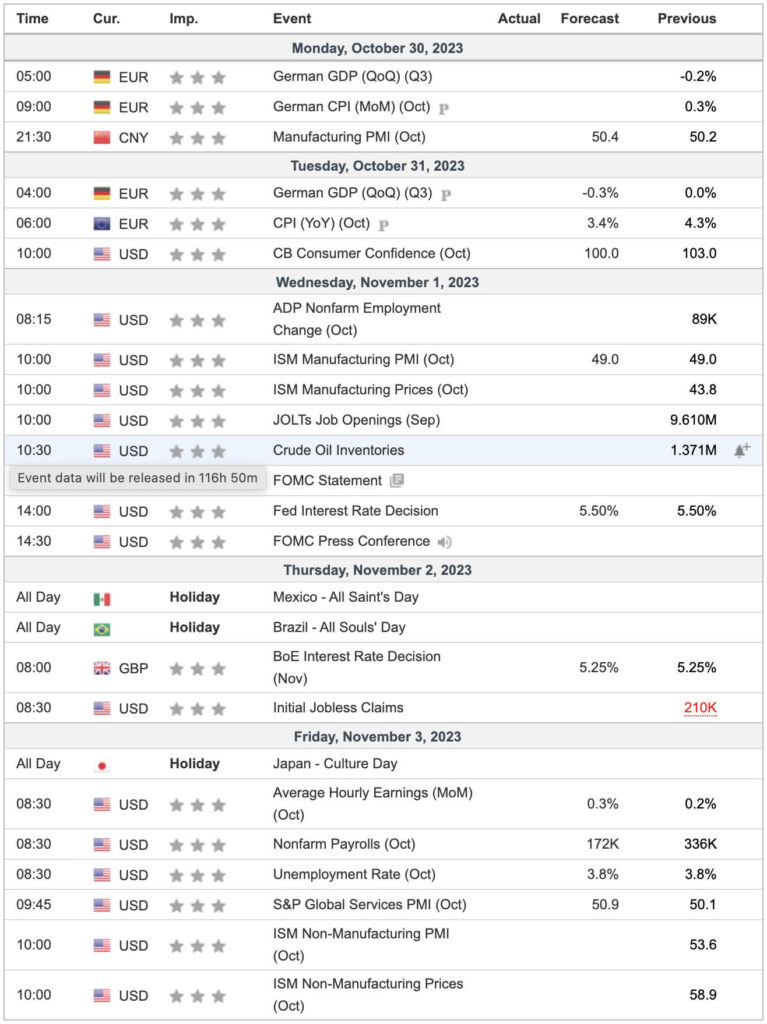

Next week will bring a series of key economic events that could have significant implications for global markets. Here are some of the highlights to keep in mind:

- Economic Data from Germany:

GDP (QoQ) (Q3): A contraction in the German economy is expected, with a decrease of -0.2% and subsequently -0.3%. Germany, being the largest economy in the Eurozone, has a strong impact on the overall economic health of the region. These figures suggest it might be facing headwinds. CPI (MoM) (Oct): An increase of 0.3% could signal inflationary pressures in the economy.

- Data from China:

Manufacturing PMI (Oct): An expected value of 50.4, slightly higher than the previous data of 50.2. This figure is crucial as it indicates the health of the manufacturing sector in the world’s second-largest economy.

- Updates from the U.S.:

CB Consumer Confidence (Oct): A slight drop to 100.0 from 103.0 is expected, which could reflect less optimism among consumers. ISM Manufacturing PMI and Prices (Oct): Both indicators are essential to understanding the health of the manufacturing sector and inflationary pressures in the U.S. FOMC Statement and Fed Interest Rate Decision: One of the most anticipated events. Interest rates are forecasted to remain at 5.50%. However, the FOMC’s words could provide clues about future monetary policy decisions. Nonfarm Payrolls (Oct): Nonfarm payrolls are a crucial indicator of the health of the labor market. Although a figure of 172K is expected, it is significantly lower than the previous month, which could impact market sentiment.

- United Kingdom:

BoE Interest Rate Decision (Nov): The Bank of England is expected to maintain rates at 5.25%.

- Holidays: It’s essential to consider holidays in Mexico, Brazil, and Japan, as they could reduce liquidity and volatility in the related markets.

With so many key events on the horizon, investors and traders must remain alert and prepared for potential market movements. This data not only offers a snapshot of the current economic health but also provides insights into future trends.