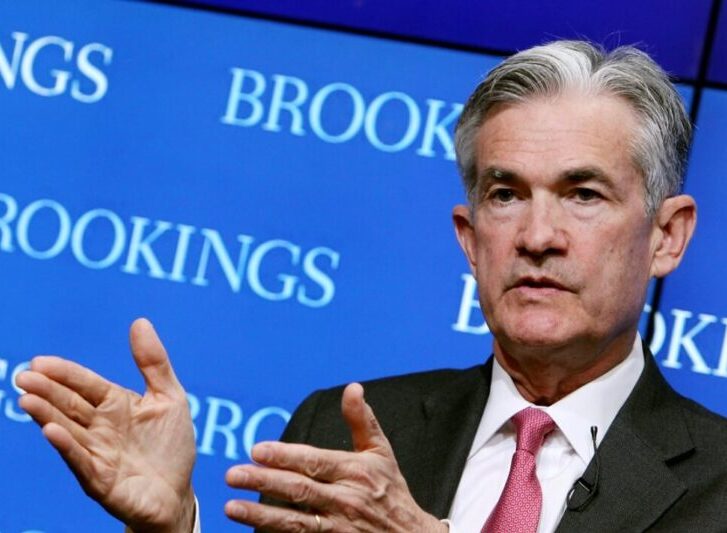

Jerome Powell, chairman of the U.S. central bank, has revealed the Federal Reserve’s stance on the future of monetary policy and the market in a context of persistently high inflation. Powell’s words have not been encouraging for the markets and raise concerns for certain sectors.

Summary of the most impactful points from Powell’s statements:

Inflation shows no signs of declining, remaining at high levels.

The FED seeks to adjust its monetary policy to achieve stable inflation around 2%.

Current measures do not seem to be restrictive enough to reach that goal.

It is possible that interest rates have not been raised sufficiently to counteract the rapid rise in prices. An appropriate rate hike might have served as a tool to cool the economy and, thereby, control inflation. Without proper adjustment, the economy may continue to face inflationary challenges.

Although major banks appear secure, smaller banks might face risks. Particularly, credit conditions could become problematic for small businesses.

Recently hinted at the possibility of increasing the implementation of the QT (Quantitative Tightening) policy by selling assets owned by the FED. This tactic aims to reduce excess liquidity in the financial system, which can lead to inflationary pressures. By selling assets, the FED aims to absorb some of that liquidity, potentially leading to a tightening of monetary conditions and helping stabilize the economy. This strategy signals the central bank’s intention to take proactive measures in the face of persistent inflation and current economic challenges.

Substantial adjustments to the FED’s roadmap are anticipated.

The Federal Reserve has shown clear determination in its objective of steering monetary policy towards a more restrictive stance. This direction is adopted to control inflation and ensure long-term economic stability. By taking a more restrictive stance, the central bank also seeks to reaffirm market and investor confidence, understanding that proper control of the money supply is essential to maintain the balance and health of the economy. This commitment reflects a proactive response to current economic challenges and inflationary trends.

Conclusion: Despite external situations, such as international conflicts in which Powell showed his support for Israel, the Federal Reserve remains firm in its intent to continue with the adjustment and its goal of reducing inflation to 2%. These adjustments could create complications for banks and businesses, especially smaller ones. Furthermore, the reduction of dollar circulation, resulting from these measures, might not be favorable for the stock market, which could have repercussions on investments and the financial health of institutions.