In the following text, we’ll break down some of the most significant economic events on the horizon. We have a busy week in the economic sphere, but don’t worry; we’re going to explain each event in a clear and simple manner. Even if you’re not well-versed in economics, we’ll provide a clear understanding of the significance of each event, so you can understand how they might personally affect you and the economy at large.

New Zealand Interest Rate Decision (Wednesday, November 29th): Here, the central bank of New Zealand decides whether to change its main interest rate. This change can affect the value of its currency and the economy in general. If rates increase, it could indicate a stronger economy, but it could also make loans more expensive.

U.S. GDP (Quarterly) (Wednesday, November 29th): The Gross Domestic Product (GDP) measures the total value of all goods and services produced in the U.S. and is a key indicator of the country’s economic health. A high GDP suggests a strong economy, while a low figure may indicate economic problems.

U.S. Crude Oil Inventories (Wednesday, November 29th): This data shows how much crude oil is stored in the U.S. Changes in these levels can affect oil prices, which has a broad impact on the global economy, as oil is a key resource.

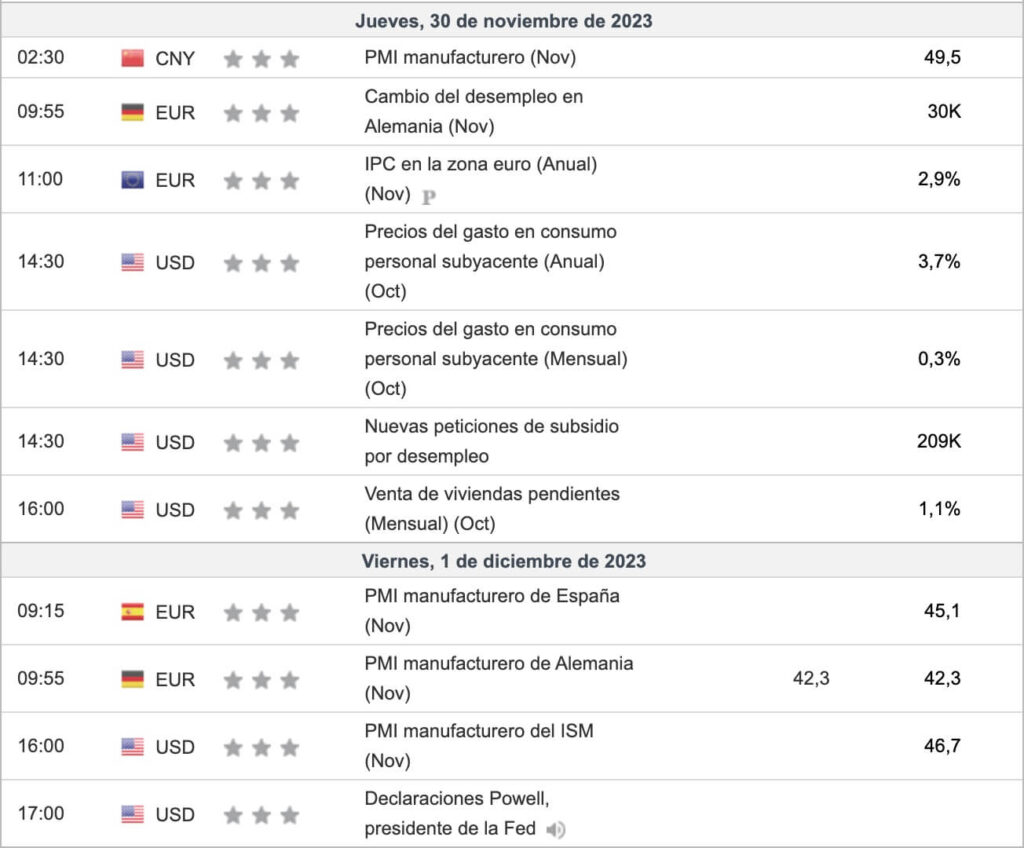

U.S. Manufacturing PMI from ISM (Friday, December 1st): The Purchasing Managers’ Index (PMI) measures the health of the manufacturing industry. A number above 50 indicates expansion, while one below 50 suggests contraction. It’s a good indicator of how the economy is performing in the manufacturing sector.

Statements by Powell, Fed Chairman (Friday, December 1st): Statements by Jerome Powell, the chairman of the U.S. Federal Reserve (Fed), are important because any hints about future monetary policy can influence financial markets. His comments can affect investment decisions and economic expectations.

These events are key because they can affect the global economy, exchange rates, and investment decisions in financial markets.