In the ensuing discussion, we’ll unpack a selection of pivotal economic happenings that are forthcoming. If the world of economics isn’t your forte, fear not; we aim to clarify the importance of each occurrence in an accessible and transparent way, allowing you to grasp their potential impact on both your own financial situation and the broader economic landscape.

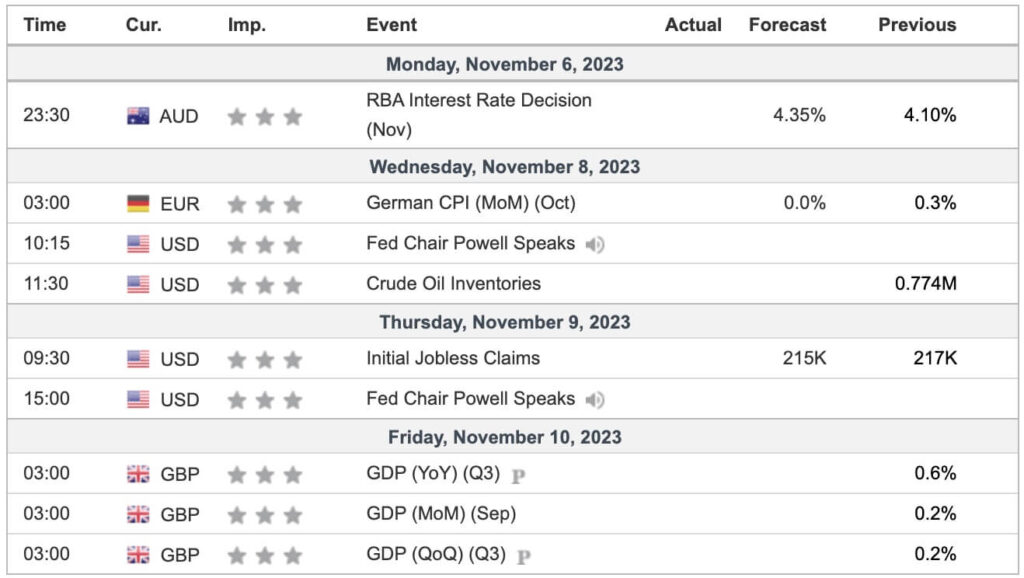

1. RBA Interest Rate Decision (Nov) The Reserve Bank of Australia’s (RBA) interest rate decision is a critical indicator of the country’s monetary policy. An increase in the rate, as suggested here from 4.10% to 4.35%, may indicate an attempt to curb inflation and cool economic growth, while a decrease could aim to stimulate investment and consumption.

2. German CPI (MoM) (Oct) Germany’s Consumer Price Index (CPI) measures inflation from the consumer’s perspective. A monthly change from 0.0% to 0.3% may seem small, but it’s a significant indicator of inflation trends in Europe’s largest economy and can influence the European Central Bank’s monetary policy decisions.

3. Fed Chair Powell Speaks When the U.S. Federal Reserve Chair speaks, markets listen. His speeches are scrutinized for clues about the future direction of monetary policy, including interest rates and economic stimulus measures, which can impact global financial markets.

4. Crude Oil Inventories The U.S. crude oil inventory figures provide insight into oil supply and demand, which can affect global oil prices. An increase in inventories can suggest a decrease in demand or an oversupply, often leading to lower oil prices.

5. Initial Jobless Claims This weekly data measures the number of people filing for new unemployment insurance claims in the U.S. and is an early indicator of labor market health. An increase in claims can signal a slowdown in employment and possibly the economy at large.

6. UK GDP (YoY, MoM, QoQ) (Q3) The UK’s Gross Domestic Product (GDP) is a measure of total economic activity. Annual, monthly, and quarterly data provide a comprehensive view of the country’s economic health. Positive growth indicates expansion, while a negative figure can signal an economic contraction.

Each of these points offers insight into different facets of the global economy and can have significant implications for investors, policymakers, and the general public.