If economics seems like a complicated topic to you, don’t worry! Here we break down some of the most relevant economic events of the week, with simple explanations:

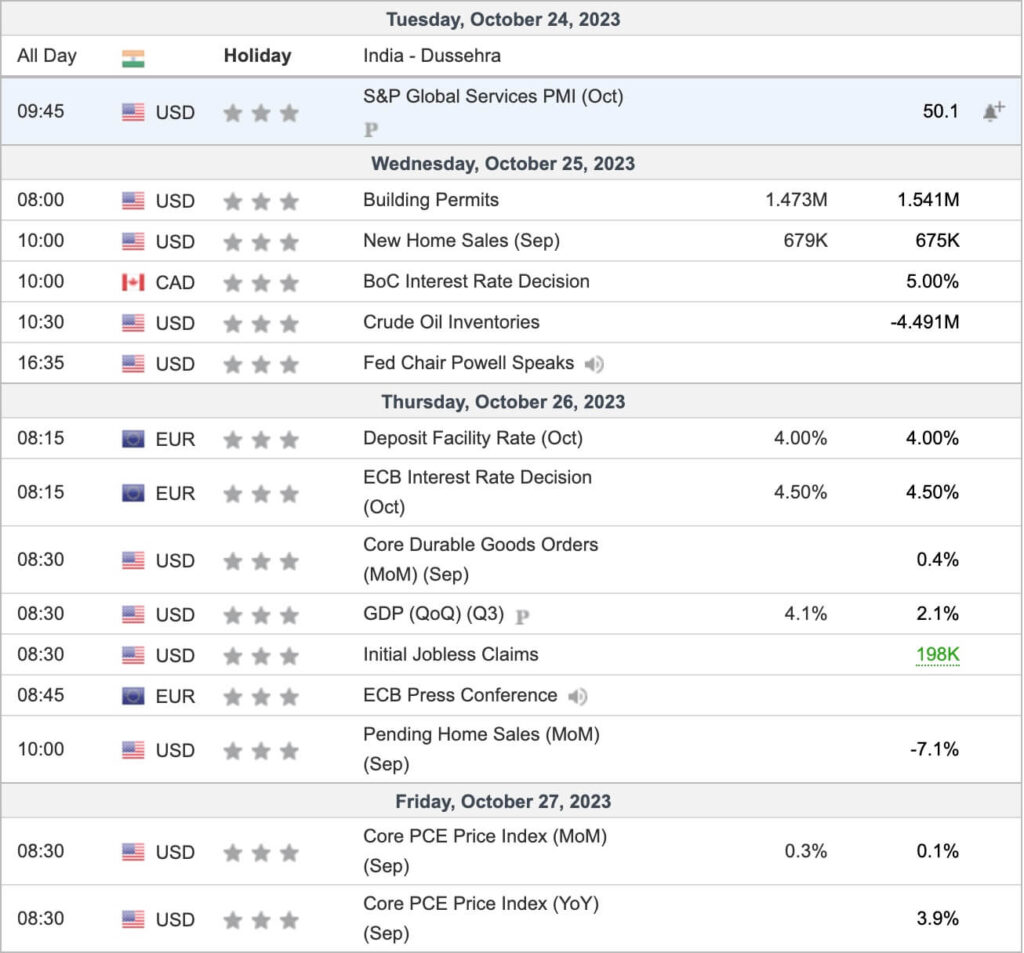

Tuesday, October 24, 2023

S&P Global Services PMI (Oct) – USD 50.1: It shows the state of services in the US. A number above 50 indicates growth.

Wednesday, October 25, 2023

Building permits – USD 1.473M: Indicates how many new permits have been issued. It reflects the health of the real estate sector.

New home sales (Sep) – USD 679K: Tells us how many new houses have been sold. An indicator of housing demand.

Monetary policy decision announcement – CAD 5.00%: Canada will inform us about its interest rate, which affects loans and savings.

IEA crude oil inventories – USD -4.491M: Shows how much oil they have stored. It can affect crude prices.

Statements by Powell, chairman of the Fed: The leader of the US central bank will speak, his words can influence markets.

Thursday, October 26, 2023

Unemployment rate (Sep) – MXN 2.70%: Tells us what percentage of Mexicans are unemployed.

Deposit facility rate (Oct) and ECB monetary policy decision announcement (Oct) – EUR 4.00% and 4.50% respectively: Decisions by the European Central Bank that affect the eurozone economy.

Durable goods orders (core) (Monthly) (Sep) – USD 0.4%: Displays the demand for products that last more than three years, like appliances.

GDP (Quarterly) (Q3) – USD 4.1%: Indicates how much the US economy has grown in the third quarter. New unemployment benefit claims – USD 198K: Reflects how many people have applied for unemployment assistance.

European Central Bank (ECB) press conference: They will discuss monetary policy and the economy of the eurozone.

Pending home sales (Monthly) (Sep) – USD -7.1%: Indicates the number of home sales that are pending closure.

Friday, October 27, 2023

Prices of underlying personal consumption expenditure (Annual and Monthly) (Sep) – USD 3.9% and 0.3% respectively: Indicate how the prices of goods and services consumed by households have changed.

Conclusion: In an interconnected world, economic indicators impact beyond national borders. Inflation in Mexico, monetary policy decisions in Canada and Europe, and the state of the real estate sector in the U.S. influence the global economy. Words from leaders like Powell guide market expectations, showing how small changes can resonate globally.